Assessing ESG Risk & Resilience In Global Supply Chains

Rapidly baseline your Supply Chain’s ESG health and drill into

key risk and resilience areas with Ethixbase360’s ESG Explore

Supply Chain Report

Solutions By Risk Area: ESG

Gain rapid insight into your Supply Chain’s ESG health

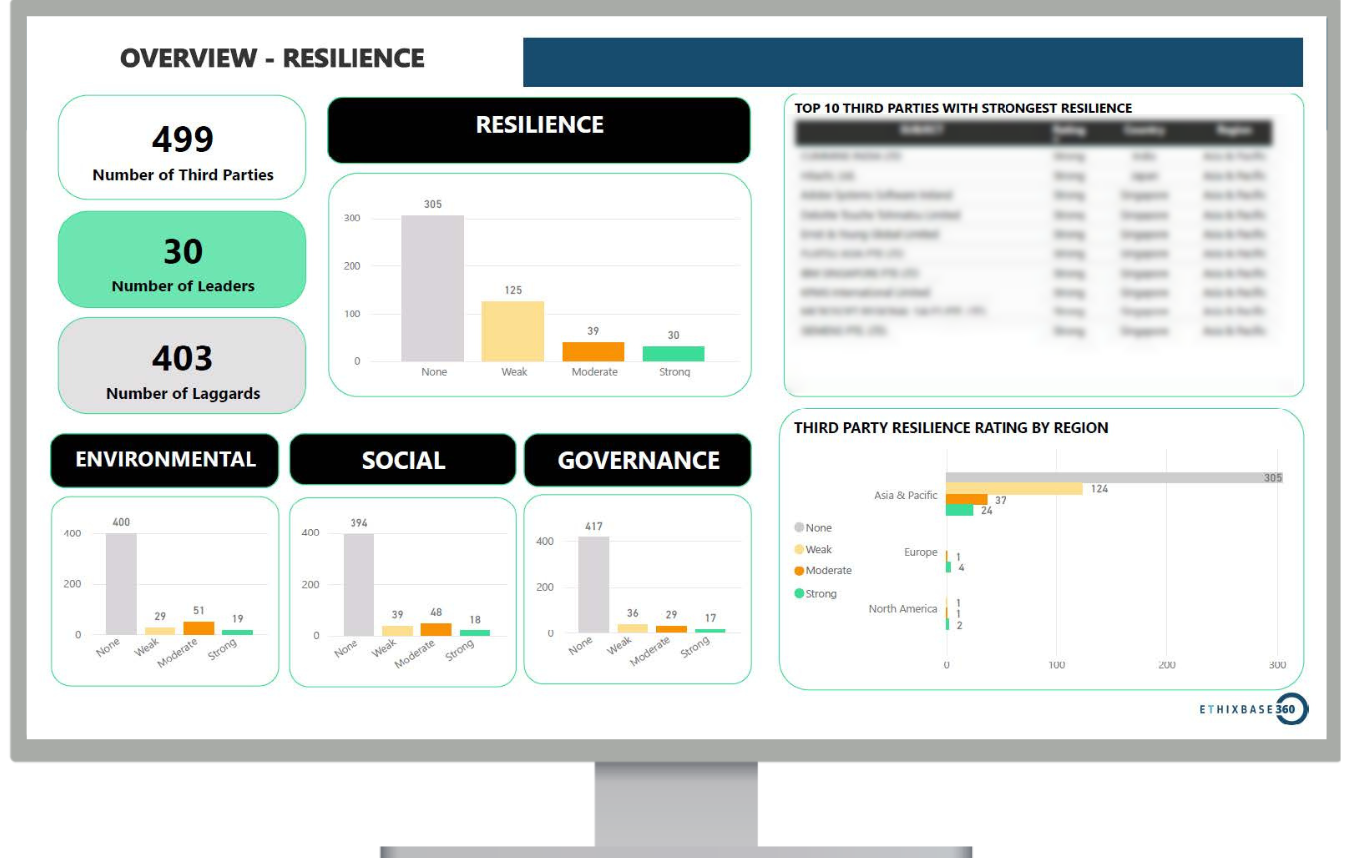

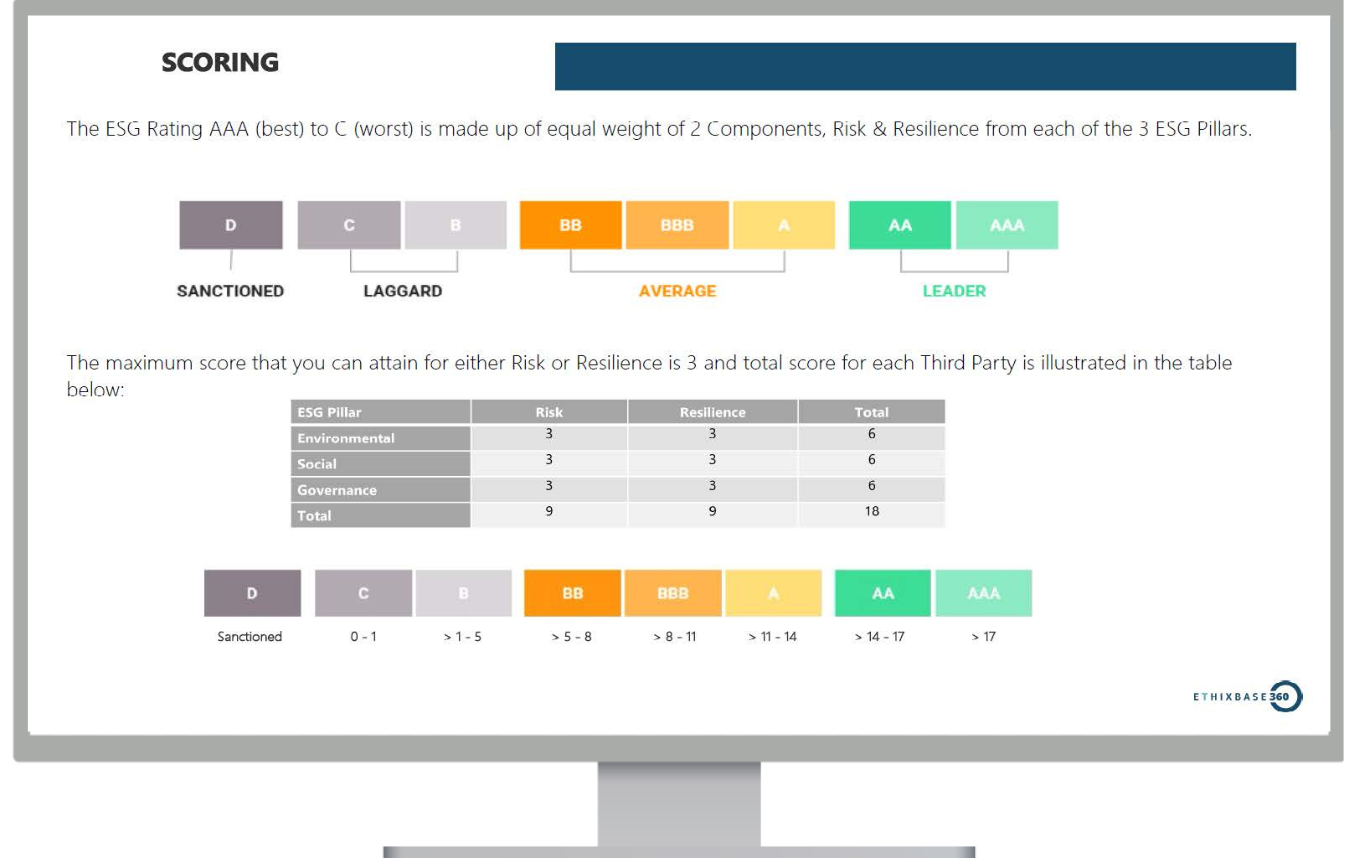

Take a complete approach to ESG standards across your supply chain with the Ethixbase360 ESG Explore report. Assess 100% of suppliers, or a selected cohort, to baseline ESG Risk and Resilience areas and make educated decisions about where further due diligence or direct engagement may be required.

Explore ESG In Your Supply Chain

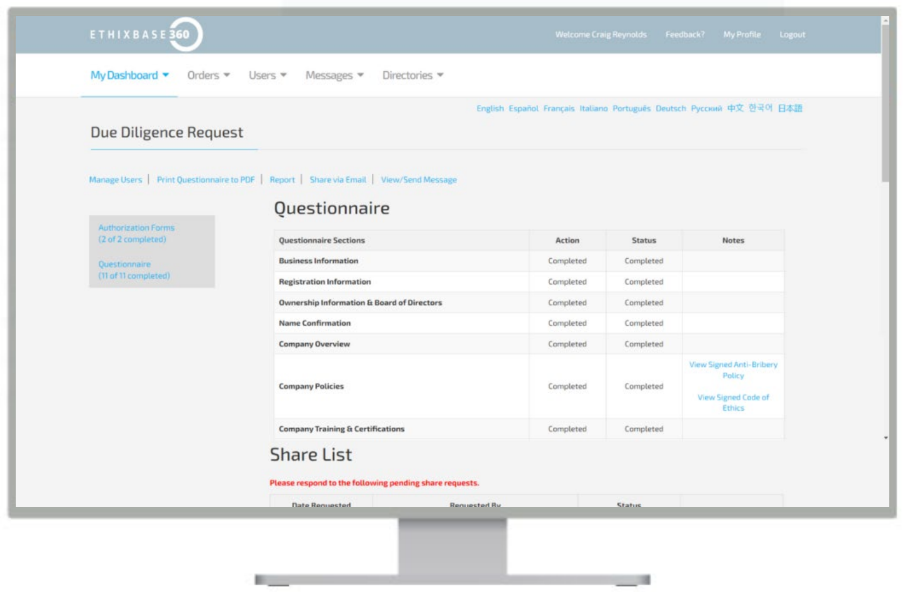

Rapidly understand the ESG health of your supply chain with an overarching ESG report and drill-down reports available for each supplier. ESG Explore does not relyon lengthy questionnaires and requires no direct third-party engagement for the initial review. Risk alerts are reviewed for false positives to ensure your business has actionable insights.

Report To Key Stakeholders

ESG Explore’s Supply Chain report offers rapid insight into your Supply Chain’s ESG posture with actionable insights to drive decision-making at the highest level. Our innovative Explore, Enhance, Engage methodology allows you to achieve a baseline overview of the supply chain and make educated decisions about further actions if and where required.

Enhance Insight

Clients can choose to leverage Ethixbase360’s in-depth ESG-specific Enhanced Due Diligence reports where required. With research operations centres across seven countries and conducting research in 35 in-house languages, our research reports can assess ESG policies, practices, and risk areas when you need to know more about critical suppliers.

Engage, Elevate & Track Progression Overtime

Ethixbase360 also offers the opportunity to elevate standards, facilitate transparency, and promote principled performance in the supply chain by

engaging directly with key suppliers in areas of concern and/or opportunities for improvement. The impact of your organizations ESG program can be tracked over time with detailed progression reporting available.

ESG Explore Key Features

Supply Chain ESG Report

Receive a report baselining your supply chain's ESG posture within as little as two weeks. Includes supply chain score and the ability to drill into specific risk areas and supplier profiles.

Assess Individual Suppliers

Tease out supply chain leaders and laggards with the ability to drill into specific supplier’s reports. Reports are reviewed for false positives by our trained team of analysts to ensure noise is removed.

Search Supplier’s Publicly Available Policies

Assess resilience and awareness of obligations with a search of Supplier’s publicly available policy documentation from their website.

Beyond the Numbers: Corporate ESG Spending Gains Momentum Amid Calls for Transparency

Read BlogExplore, Enhance, Engage

Learn more about our proprietary Explore, Enhance and Engage methodology, which enables you to manage you supply chain compliance and security based on risk exposure.

Ready to get started?

Let's talk. One of our representatives can help you shape your project.

Book Consultation“Excellent is a very difficult concept to achieve, I do not want to oversell my satisfaction, but generally I am extremely satisfied with [Ethixbase360]. I would go for 9/10 for their customer service and the same perception is from within the organization. I never received negative feedback from our team and our users rated the platform being easy, really intuitive and they like it.”

Head Group of Compliance

Global Agri-business Company

“Ethixbase360 has been really helpful and responsive. The platform itself is very user-friendly and everything now is much more organized for us and there’s a lot more automation in the process now. They have been really helpful with not just the product, but also suggestions. They’ve sometimes steered us towards more cost-effective things that would provide a similar level of protection. I’ve never been frustrated with waiting for a response.”

Group Compliance Manager

Global Medical Devices Suppliers

“Everything is valuable in Ethixbase360’s platform, from the moment they trigger the automatic email directly to the third parties, the third parties respond directly via the platform, the Enhanced Due Diligence (EDD) reports are good, the Instant Due Diligence Plus (IDD+) is a very good complement for management changes. The whole process is very useful.”

Head Group of Compliance

Fortune 500 Pharmaceutical Company

“The greatest value for us is the documentation on the system of three elements: compliance clause, due diligence questionnaire and code of conduct for each third party. Also, what is valuable is the fact that they were designed by us and it’s configurable.”

Head Integrity & Compliance

Global Retail Company

Resources

Our Latest News, Case Studies, Webinars & More