Supply Chain Due Diligence Software

Dive deep into potential compliance issues across your third-party network.

RISK AREA: SUPPLY CHAIN DUE DILIGENCE

Maintain Lieferkettengesetz (LkSG) compliance through Ethixbase360.

Our due diligence questionnaire and risk assessment simplifies continued compliance throughout your supply chain.

Direct Engagement

Germany’s adoption of stricter supply chain due diligence is challenging companies of all sizes to learn more about third parties. Our Lieferkettengesetz Questionnaire promotes direct engagement with third parties in a pragmatic format that’s simple to complete and covers key LkSG risk topics. Gain insights into your network’s human rights record, environmental risks, compliance controls and more to enable compliant reporting.

TPRM Integration

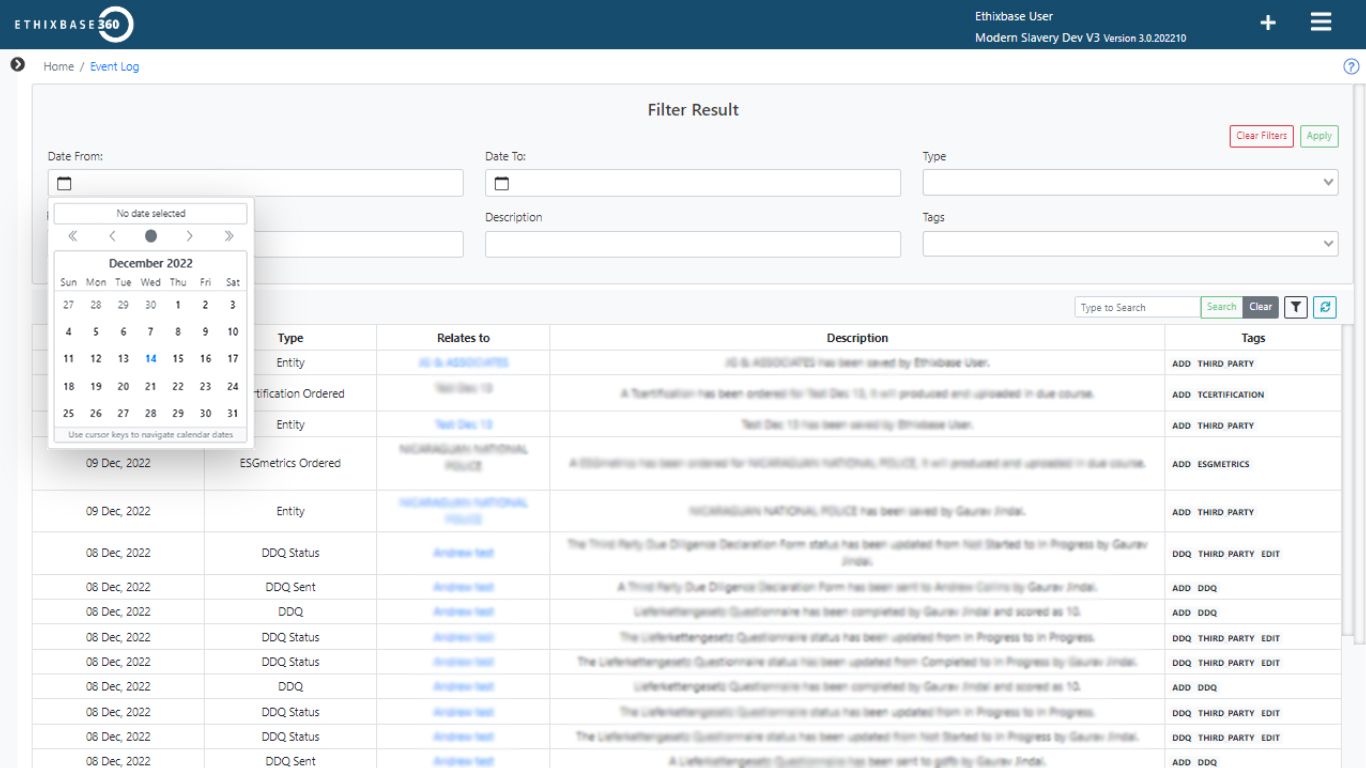

The stringent reporting requirements of LkSG necessitate gathering, organizing and storing significant amounts of critical data–and that can be a challenge no matter the size of your company and third-party network. Ethixbase360’s Lieferkettengesetz solution integrates directly with our Third-Party Risk Management solution to simplify the due diligence process for in-house compliance teams and your supply chain partners.

Assessment & Reporting

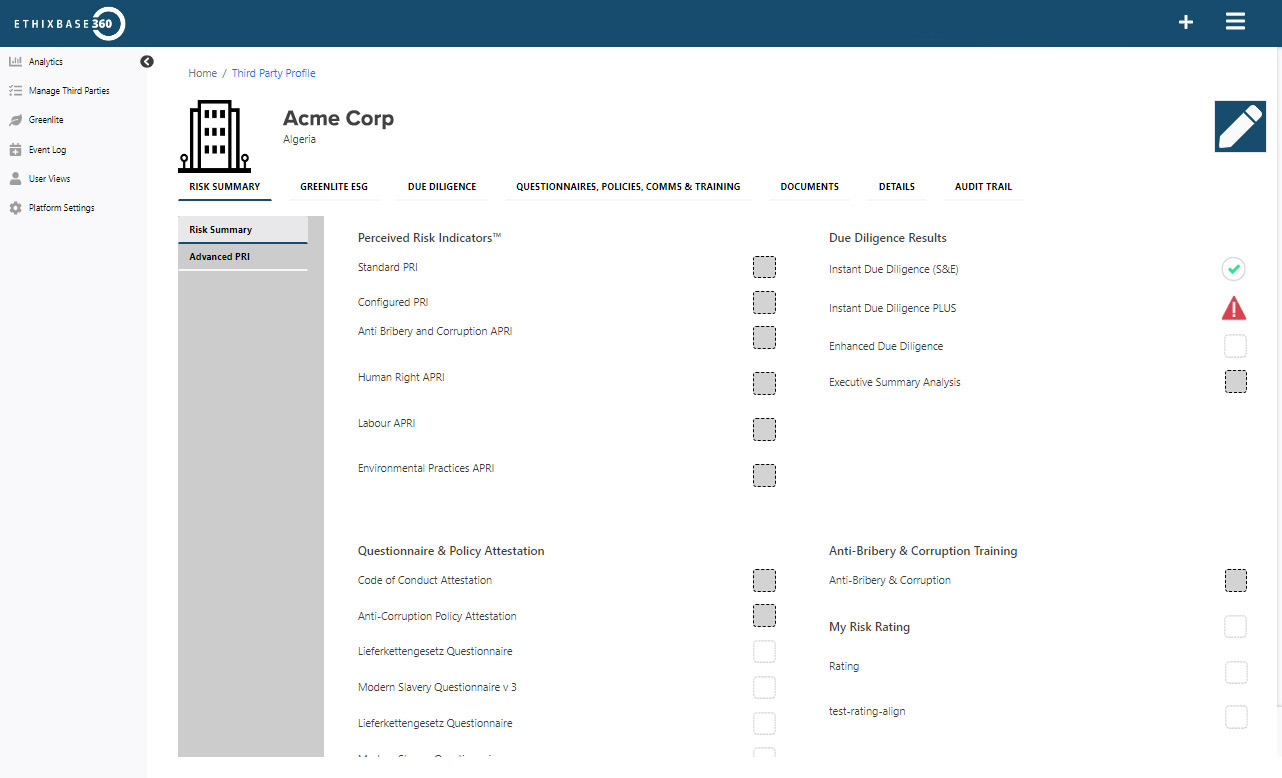

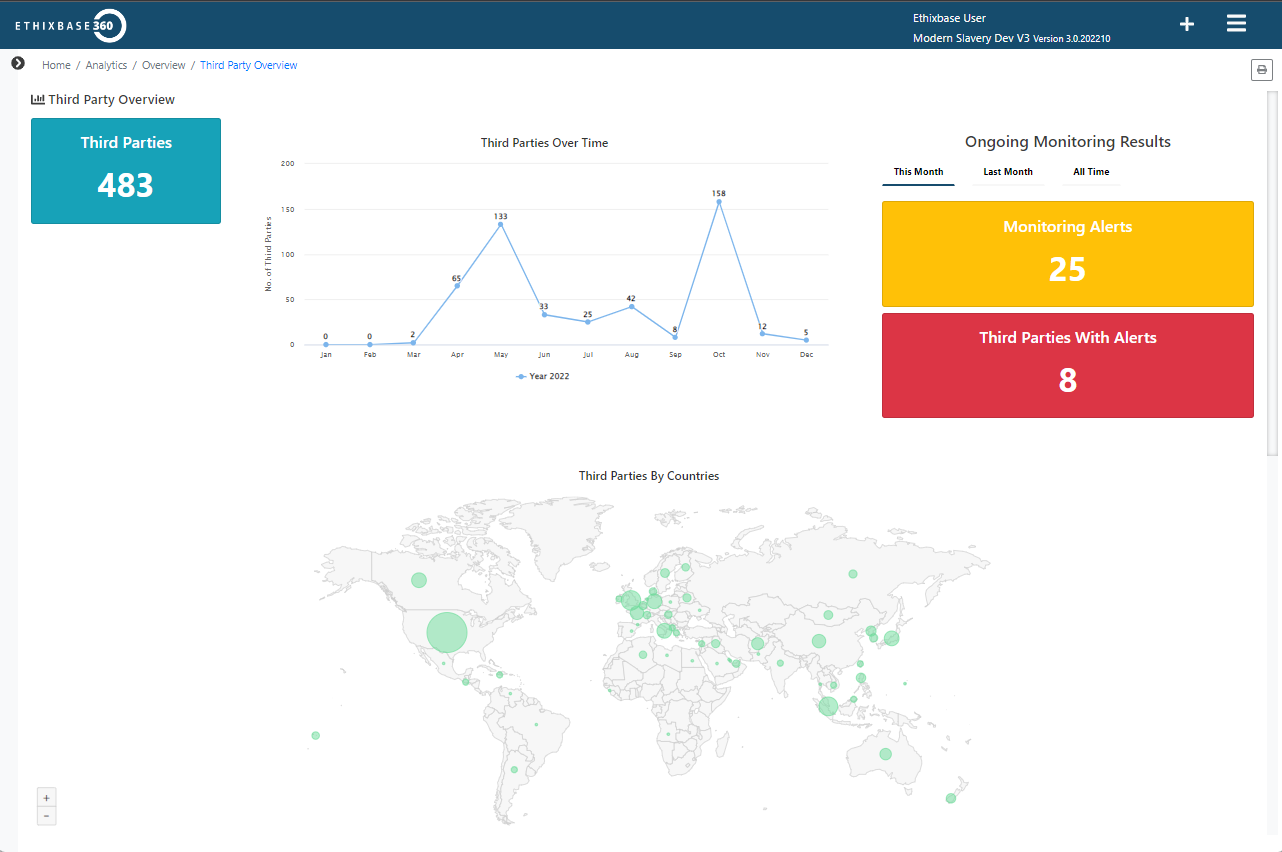

Ethixbase360 allows you to drill down into specific risk areas at the third-party level. The robust methodology designed and updated by Norton Rose Fulbright allows you to risk rate third parties and gain actionable mitigation insights. Assessment and reporting on the impacts of your risk management efforts provides visual comparison of progress year-over-year to help chart your path forward to improved standards across your network.

Enhanced Due Diligence

Due diligence looks different based on a variety of factors, from geographic location to company size and more. Ethixbase360 makes it easy to get the information you need with features including analysis in more than 35 languages, 12-month ongoing monitoring and the ability to configure automated workflows based on risk assessment and monitoring alerts. The solution scales and flexes as your supply chain evolves.

Capabilities

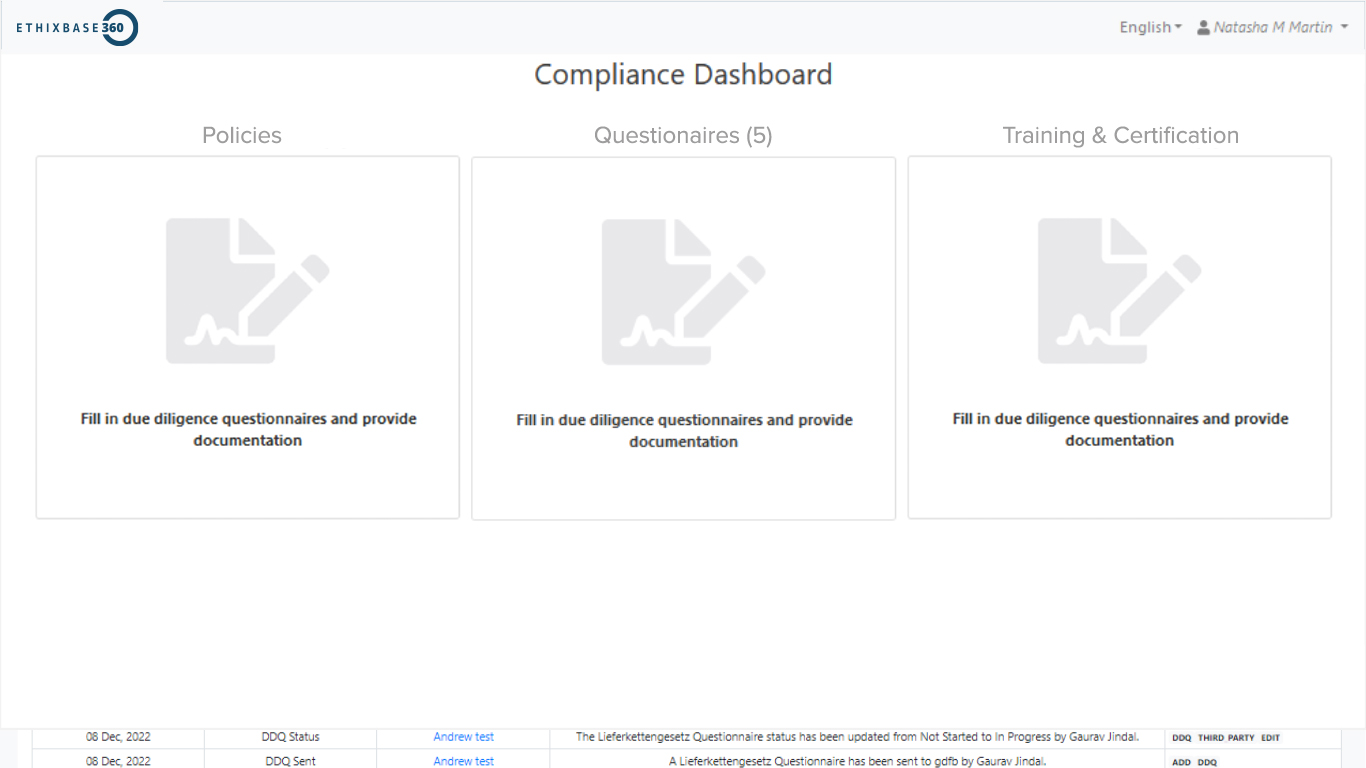

Questionnaires

Engage third parties directly with easy-to-complete, responsive questionnaires developed by legal

experts

Reporting & Analytics

Instantly find the information you need in real-time to confirm third-party compliance

Risk Assessment

Assess risk across your third parties with automated risk ratings defined by your criteria

Screening & Monitoring

Safeguard your business and ensure compliance with instant screening, false positive remediation, and

continuous monitoring.

Workflows, Configuration & Integrations

Create automated risk-based workflows for faster decision-making and global program scalability

Explore, Enhance, Engage

Safeguard your reputation with a 360° view. Try Ethixbase360 now.

Ready to get started?

Let's talk. One of our representatives can help you shape your project.

Book Consultation“Everything is valuable in Ethixbase360’s platform, from the moment they trigger the automatic email directly to the third parties, the third parties respond directly via the platform, the Enhanced Due Diligence (EDD) reports are good, the Instant Due Diligence Plus (IDD+) is a very good complement for management changes. The whole process is very useful.”

Head Group of Compliance

Fortune 500 Pharmaceutical Company

“Excellent is a very difficult concept to achieve, I do not want to oversell my satisfaction, but generally I am extremely satisfied with [Ethixbase360]. I would go for 9/10 for their customer service and the same perception is from within the organization. I never received negative feedback from our team and our users rated the platform being easy, really intuitive and they like it.”

Head Group of Compliance

Global Agri-business Company

“Ethixbase360 has been really helpful and responsive. The platform itself is very user-friendly and everything now is much more organized for us and there’s a lot more automation in the process now. They have been really helpful with not just the product, but also suggestions. They’ve sometimes steered us towards more cost-effective things that would provide a similar level of protection. I’ve never been frustrated with waiting for a response.”

Group Compliance Manager

Global Medical Devices Suppliers

“The greatest value for us is the documentation on the system of three elements: compliance clause, due diligence questionnaire and code of conduct for each third party. Also, what is valuable is the fact that they were designed by us and it’s configurable.”

Head Integrity & Compliance

Global Retail Company

Resources

Our Latest News, Case Studies, Webinars & More

Will Canada’s Modern Slavery Act Become North America’s De Facto Law?

Brad Gates, regional head for the Americas at Ethixbase360, contributed to the discussion surrounding Canada’s groundbreaking Modern Slavery Act and […]Energy Corporation Mexico S.A. Unwavering Commitment to Compliance

Corruption continues to be a significant risk for companies operating in Mexico despite a growing demand for more transparency and […]Building a Robust and Resilient Supply Chain through Third-Party Risk Management

Webinar Summary Join us on our webinar “Building a Robust Supply Chain through Third-party Risk Management.” This webinar represents the […]European Union’s ESG Laws on a Roller Coaster: What It Means for Your Company

Two important European Union directives meant to advance corporate ESG due diligence obligations recently went through roller coaster developments that […]CSDDD: A New Dawn for Corporate Sustainability?

Overcoming Obstacles: The Journey to Approval of the CSDDD After weeks of negotiations, delays, and political manoeuvring, the European Commission […]Navigating APAC’s Compliance Landscape: A Deep Dive Into Third-Party Risk

Webinar Summary In this session, we’re delving into the intricate landscape of regulatory compliance and third-party risk management. With the […]Supply Chain Due Diligence FAQ's

Supply chain due diligence refers to the process of conducting a comprehensive assessment and investigation of suppliers, vendors, and partners within a supply chain to ensure their compliance with legal, ethical, and sustainability standards. It involves gathering and analysing relevant information about these entities to evaluate their practices, identify potential risks, and make informed decisions regarding their inclusion in the supply chain.

Supply chain due diligence focuses on verifying the authenticity and compliance of suppliers, assessing their financial stability, social and environmental impact, labour practices, adherence to regulatory requirements, and overall business conduct. It helps organisations identify potential risks, such as human rights violations, environmental non-compliance, corruption, or unethical actions, which could negatively impact the organisation’s reputation, operations, and compliance record.

By conducting supply chain due diligence, businesses can proactively manage risks, ensure transparency within their supply chains, foster responsible sourcing, and uphold corporate values. It helps them create a more resilient and sustainable supply chain while enhancing trust and credibility with customers, stakeholders, and regulatory bodies.

Supply chain due diligence software is a specialised tool designed to streamline and automate the process of conducting due diligence on suppliers and partners within a supply chain. It helps organisations assess and monitor potential risks associated with their suppliers, ensuring compliance, ethical practices, and sustainability throughout the supply chain.

Effective supply chain due diligence software typically offers capabilities such as supplier data collection and management, risk assessment and scoring, compliance monitoring, sustainability assessment, environmental and social impact analysis, audit trail documentation, supply chain mapping, real-time monitoring and alerts, and reporting functionalities. It should provide a holistic view of the supply chain and enable proactive risk management.