Dig Deeper with Enhanced Due Diligence Software

Gain enhanced intelligence on your third parties and their associates anywhere in the world

Enhanced Due Diligence Insight

There is no one-size-fits-all approach to due diligence.That’s why the Ethixbase360 platform provides configurable Enhanced Due Diligence reports that are relevant and proportionate to your risk exposure and business needs. This enables you to identify the intelligence you need, reducing your costs while simultaneously ensuring the fastest possible turnaround times.

Enhanced Due Diligence reports backed by robust research

- Analysis in more than 35 languages from our experienced global research team leveraging market-leading technology and databases

- Choose from three tiers of off-the-shelf risk reports or configure your own to include background analysis, Ultimate Beneficial Ownership (UBO), political exposure, bankruptcy and litigation plus more

- 12 months of continuous review included for research subjects against adverse media, political exposure, watchlists and sanctions

- Instant ordering, report access and third-party engagement services available directly through the Ethixbase360 platform

- Multi-level reports available for anti-bribery and corruption, ESG and sustainability, UBO, mergers & acquisitions, trader compliance, Uyghur Forced Labor prevention and more

- Automated workflows with configurable triggers based on risk assessments and/or monitoring alerts

Download Solution Datasheet

Enhance insight and safeguard your reputation with Enhanced Due Diligence proportionate to

your business’ risk exposure.

Download Here

Ready to get started?

Resources

Our Latest News, Case Studies, Webinars & More

Building a Robust and Resilient Supply Chain through Third-Party Risk Management

Webinar Summary Join us on our webinar “Building a Robust Supply Chain through Third-party Risk Management.” This webinar represents the […]Will Canada’s Modern Slavery Act Become North America’s De Facto Law?

Brad Gates, regional head for the Americas at Ethixbase360, contributed to the discussion surrounding Canada’s groundbreaking Modern Slavery Act and […]Energy Corporation Mexico S.A. Unwavering Commitment to Compliance

Corruption continues to be a significant risk for companies operating in Mexico despite a growing demand for more transparency and […]European Union’s ESG Laws on a Roller Coaster: What It Means for Your Company

Two important European Union directives meant to advance corporate ESG due diligence obligations recently went through roller coaster developments that […]CSDDD: A New Dawn for Corporate Sustainability?

Overcoming Obstacles: The Journey to Approval of the CSDDD After weeks of negotiations, delays, and political manoeuvring, the European Commission […]Navigating APAC’s Compliance Landscape: A Deep Dive Into Third-Party Risk

Webinar Summary In this session, we’re delving into the intricate landscape of regulatory compliance and third-party risk management. With the […]Enhanced Due Diligence FAQ's

Enhanced due diligence (EDD) refers to a deeper level of examination and scrutiny conducted on individuals, organisations, or entities who usually present a higher level of risk or complexity. It goes beyond basic due diligence procedures to gather more comprehensive and detailed information in order to assess potential risks,uncover any suspicious activities and evaluate reputation. Enhanced Due Diligence should be performed by trained and experienced analysts and is most often performed utilizing open source methodologies though source information may not be easily accessible. Where dealing with foreign entities it is also important that the research is performed by native speakers.

Enhanced due diligence is typically employed in situations where standard screening uncovers initial risks or may not provide sufficient insight into the involved parties, in high value transactions or where the risk of “getting it wrong” is significant to the client and/or where it is difficult for the client to obtain the required information due to a lack of transparency or language barriers. This could include scenarios such as high-value transactions, jurisdictions with a high risk of corruption, or industries prone to financial crime, in large deal transactions or in relation to initial public offerings (IPOs). Enhanced due diligence may also be used when dealing with third parties who interact with government officials.

Through enhanced due diligence, additional data is collected from reputable publicly available sources such as regulatory filings, media reports, government databases, and specialised risk intelligence platforms. In some high-risk jurisdictions, this information may not be digitized and available online. This information is thoroughly analysed, allowing for a more accurate assessment of potential risks, reputational concerns, regulatory compliance, and the overall suitability of engaging with the subject in question. Discreet inquires as to the reputation of the subject or subjects may also be performed depending on the level of Enhanced Due Diligence deployed.

The purpose of employing enhanced due diligence is to mitigate potential legal, financial, and reputational risks, and to ensure compliance with stringent regulations and standards. Enhanced due diligence has long been employed by organizations as part of anti-bribery and corruption programs such as the Foreign Corrupt Practices Act (FCPA) and the UK Bribery Act. More recently, the use enhanced due diligence has been expanded to cover emerging regulations around modern day slavery, human rights, and environmental con By conducting a more in-depth analysis of relevant information, organisations can make informed decisions regarding their business relationships and protect themselves from potential adverse consequences

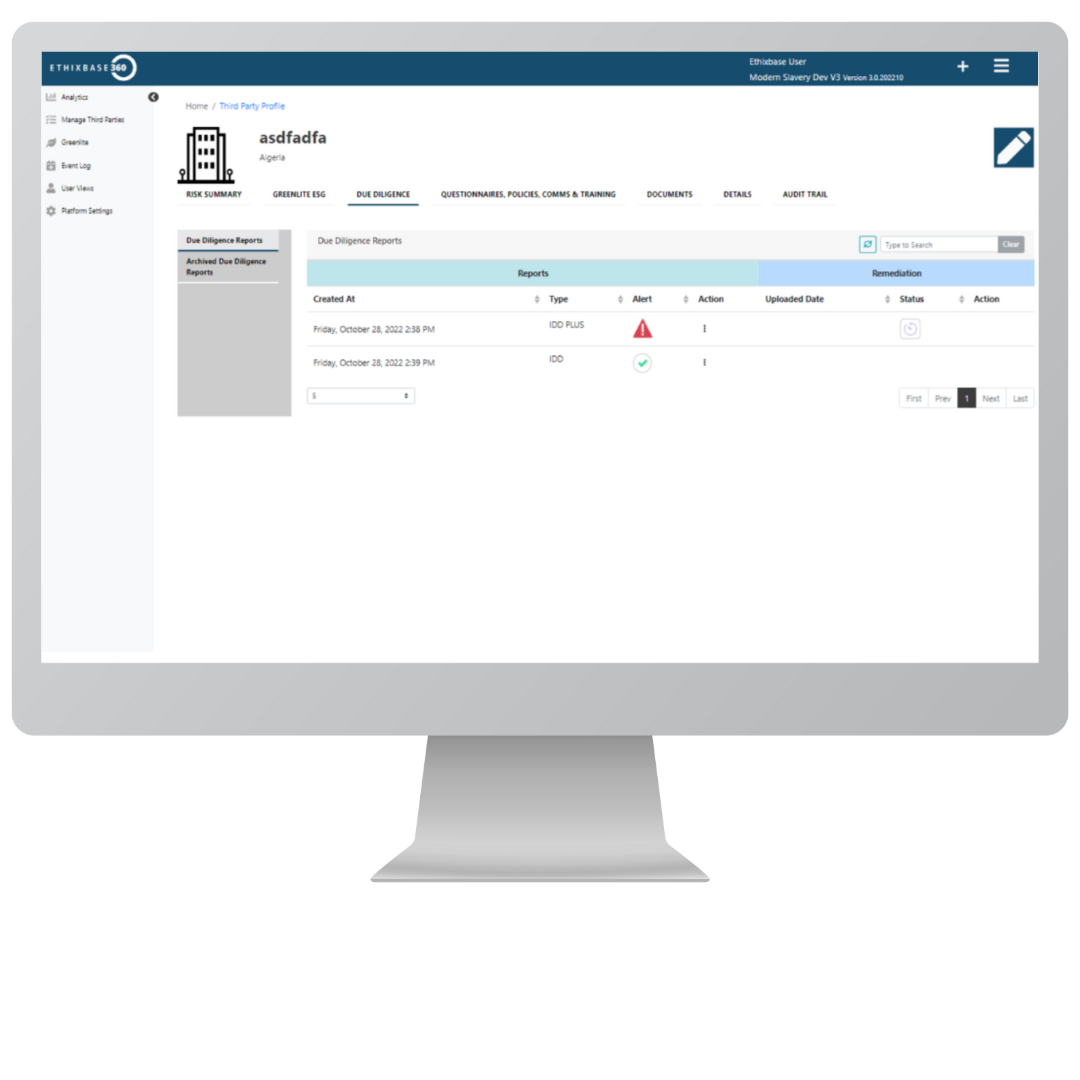

The Ethixbase360 Third Party Risk Management platform offers a streamlined and secure mechanism for managing third parties – including for the ordering of risk proportionate Enhanced Due Diligence reports when and where required. Ethixbase360 Enhanced Due Diligence reports can be ordered on any third party stored on the platform with the report delivered securely to the client’s instance, from the platform the client can report and manage third parties and their Enhanced Due Diligence reports on an ongoing basis.

Enhanced Due Diligence offers several benefits and helps organizations save time and efficiently allocate resources while ensuring the accuracy and depth of their due diligence and third party risk management efforts. Enhanced Due Diligence gives client’s access to specialized skill sets of multi-lingual analysts with local knowledge ensuring that hard to find information is surfaced and the client is aware of potential risks prior to engaging with a third party.

Ethixbase360 has a number of modules that assist in remaining compliant such as: